Adelaide property value record another month of strong growth and continue to surge.

The Advertiser

The growth rate has been eased out in the past month. But the property value has no intention to slow down.

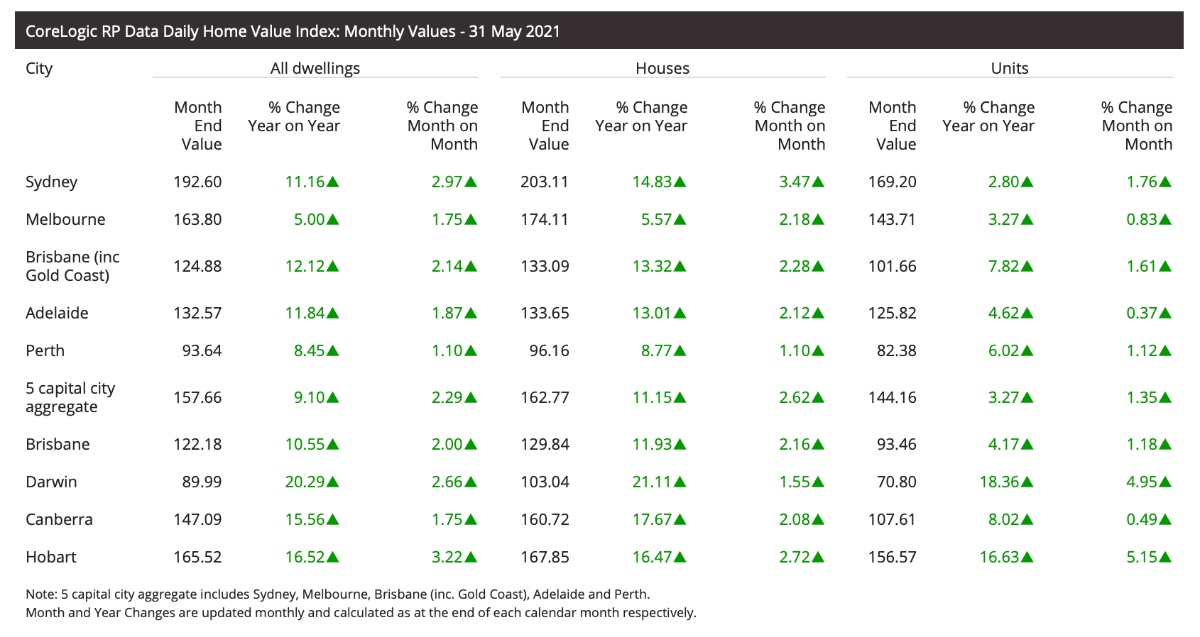

According to CoreLogic home index value index, “both of the houses and units combined – across the city rose by 1.9% in May to the median of $500,881”.

Adelaide is right now topping at 1.9% in May with 11.8% annually.

The amount of home loans that the banks are receiving has never been seen in the last two years.

According to the Reserve Bank of Australia, “credit figures show total hosing loans rose by a further 0.5% in April for an annual pace of 4.4%, the highest since 2019.

“Mortgage rates to owner-occupied rose by 0.6% to 6.2% annually, while investors finally appear to be getting on board after a noticeable absence” they added.

As the market is moving on not only, we have seen a rise in owner-occupied home loans but there is an increase in investor property financing. As the investors are becoming more active in the current market.

According to the Head of Research, Tim Lawless, “the past six months has seen the value of investors loan increased by 48.1% while the value of owner-occupier loans is up a smaller 29.7%”.

This is good news for sellers, as the buyers and investors are looking for their desired home. The market keeps getting stronger and for sure we’ll see more properties coming up in the market.

The low interest rate will continue to support consumer confidence combining with the improved economic condition that has created a consistently strong demand in the housing market.