Property appraisals are about 38% higher than winter 2020 and remarkably almost 48% stronger than the same time in 2019.

Onyx Stats

National home value rose to 13.9% over the last financial year. Typical time to sell the property is now 29 days. The way this market is going we have seen a huge surge in the property owners are eager to make a move to achieve more than the expected prices.

Usually, real estate market take rest in winters, but it will be a ‘Hot Winter’. By looking at the current statistics we can see that the sellers and buyers are coming up strong in spring, that is the excellent sign for the real estate market.

According to ANZ Bank, “Australian Hosing prices at the national level rise by a strong 17% through 2021, before slowing to 6% growth in 2022”.

Capital city housing prices rose 2.2% over the month of May as 10.6% higher over the current year

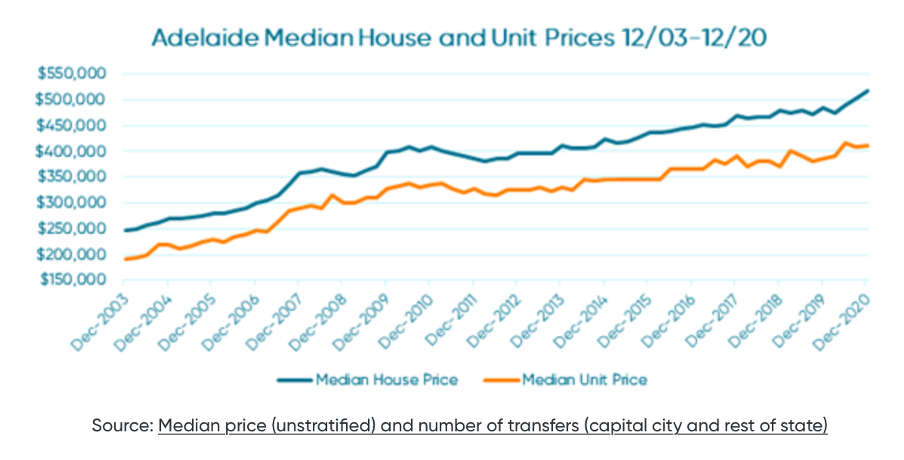

As of June 2021, Housing market in Adelaide is peaking at $508,712. By this means Adelaide has defined itself with the place for potential investors.

According to real estate institute of SA,” show people from NSW bought 168 homes in SA from January to March this year compared with 29 in the first quarter of 2020, while Victoria purchased 148 up from 44″.

Thos clearly shows that SA is topping up in their list with good return on investment as well as with good level of stability, liveability and innovation. This is undeniable fact that the homer value in SA is going up and there is no point of turning back.

Steady and consistent that’s what the Adelaide rental market is and yes, with the little hiccups over time, but it won’t dissolve the rental market. In June 2021 the rental yield for the houses and unit is sitting at 4.2% and 5.3% respectively. Rental properties in Adelaide persisted resilient over the past years.

The main driving force for South Australian economy is Adelaide and is consistent growth.

follow us: