Investment in Adelaide will provide consistent growth and price stability that combines with liveability and affordability.

As the market moving on, we can see a good opportunity for investors who want to buy or hold property in the beautiful suburbs in Adelaide.

According to John Lindeman, “Adelaide avoids boom and burst that other city housing market experience resulting in much more consistent rate of price growth than bigger cities”.

Adelaide undertook amazingly to COVID-19 situation, where other cities experienced a huge market dip, Adelaide was the least vulnerable in Australia and didn’t change many policies including international migration and investing commotion.

Suburbs like Tennyson, Walkerville, Glenunga, Semaphore, Prospect, Blackwood, Large Bay, Port Elliot, Tea Tree Gully, Salisbury are a few of the popular suburbs where the investment activity has seen a spike in the property market.

There has been a spike in short-term accommodations, as Adelaide has opened up the border for interstate and people are coming in to enjoy their short-term vacations, giving a great cash boost to the landlords who are looking to lease their property for short period of time.

As per Simon Pressley, Head of research, “Despite the Adelaide is not on the firm’s top list of Australian location to invest in right now, they consider the city to be a solid property market”.

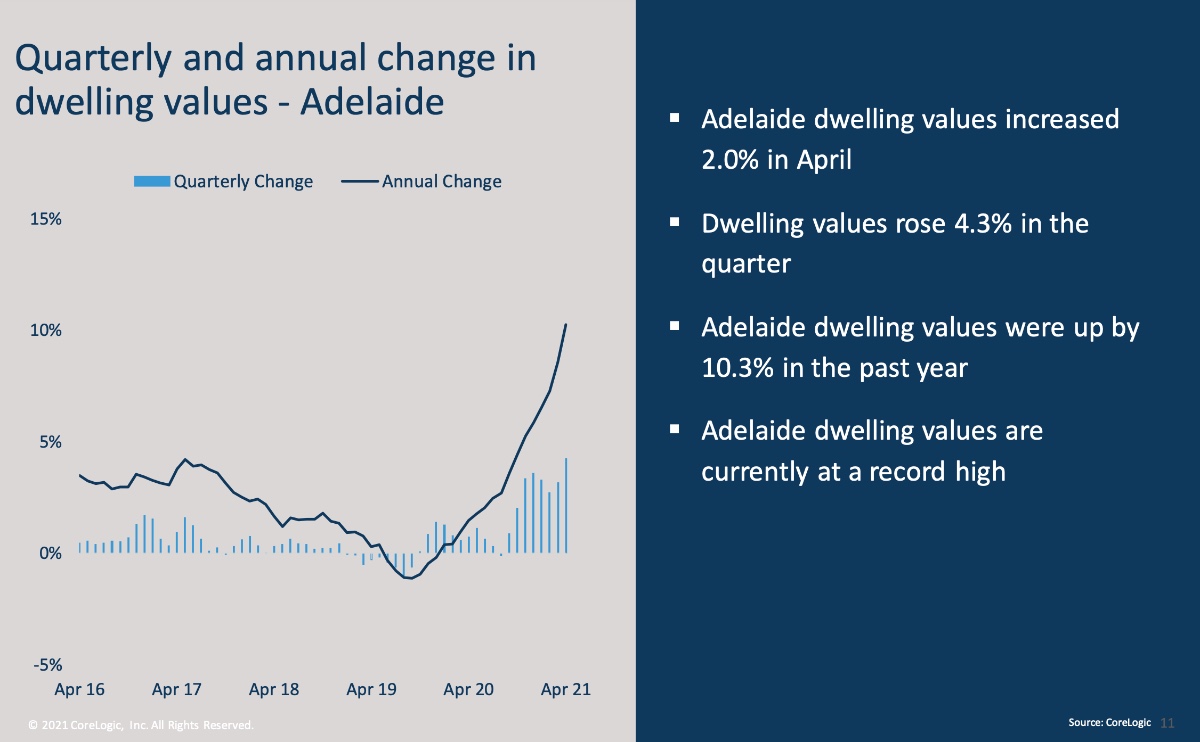

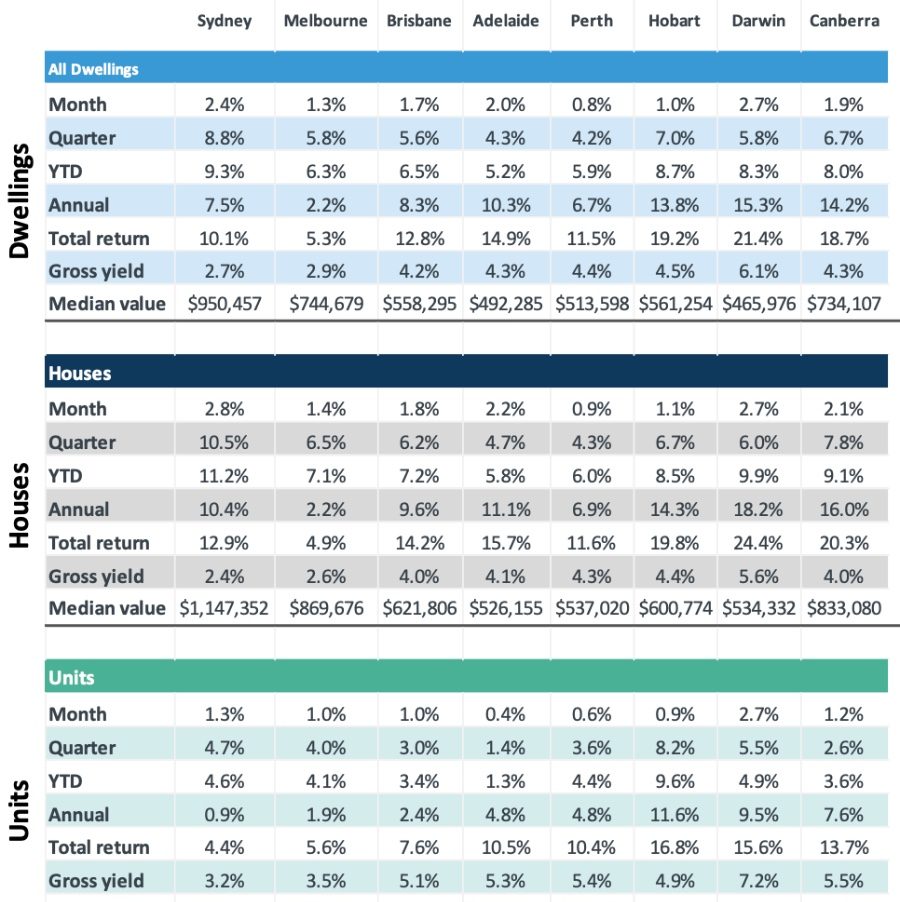

According to CoreLogic Home Index Value:

“The city affordable housing, controlled volumes of new housing supply, tight rental supply, and an appealing lifestyle are solid fundamentals for growth” he added.

Seems like Adelaide is doing great in terms of handling the COVID-19 situation, showing reliable growth in the property market.

This is the time to take advantage of the tide and take every opportunity that the market is offering in your favour.

(Source: CoreLogic, Your Investment Property, Realestate.com.au)